The federal government doesn’t need the help of state licensing boards to collect federally guaranteed student loans. The Protecting JOBs Act is a modest reform. More importantly, the legislation allows people to engage in the profession for which they are trained and qualified, which is a necessity if we expect them to pay down their outstanding student loan balances. It clarifies that Congress does not authorize states to use heavy-handed collection methods in the name of the Department of Education.

The legislation, as introduced, is a helpful addition to the growing list of licensing reform efforts seen across the country at the state level. The act would give states two years to comply, and would provide a mechanism for borrowers to enforce the act in court, if necessary.

#States revoking licenses over student loan defaults professional#

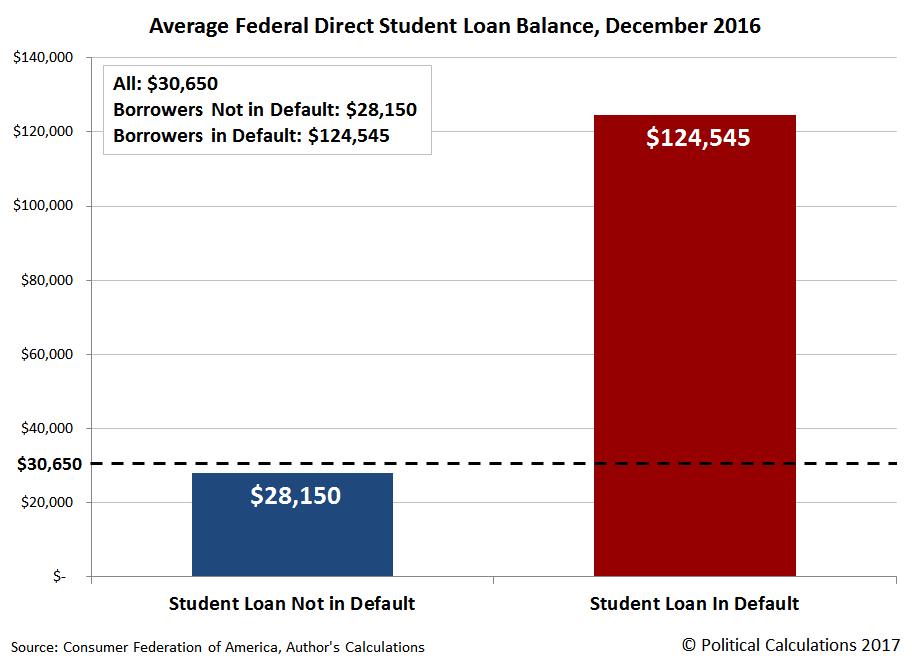

Specifically, the Protecting JOBs Act would prevent states from denying, suspending, or revoking state-issued driver’s licenses, teaching licenses, professional licenses, or other employment credentials solely because the worker defaulted on his or her federal student loans. Marco Rubio (R-Fla.) and Elizabeth Warren (D-Mass.) introduced a bill that would prohibit states from revoking occupational licenses of workers who have defaulted on student loans owned by the U.S. And because it’s hard to see what the ability to pay personal loans has to do with one’s ability to competently perform a job as a cosmetologist or landscape contractor, for example, these policies may lack a sufficiently rational connection.įortunately, these overzealous state debt-collection policies soon could be prohibited. The Supreme Court of the United States has held that occupational licensing requirements must be rationally connected to a professional’s fitness or capacity to work in their chosen field. These policies also are constitutionally questionable. As I wrote earlier this year, taking away the ability of borrowers to work just because they defaulted on student loans “kicks people while they are down and is an abuse of the government’s licensing authority.” From a more practical perspective, it’s virtually impossible for people to bring overdue loan payments current if we take away their ability to work in their chosen fields. Such policies are colossally misguided and counterproductive. Indeed, nearly one-third of American workers must now get state permission before engaging in their chosen occupation.Īnd for those workers and professionals who manage to persevere through many hours of education, multiple exams, and hundreds (sometimes thousands) of dollars in fees, nearly 20 states have erected yet another obstacle: fall behind on a student loan and you risk losing your hard-earned license, and thus your ability to earn a living. Fortunately though, recently introduced legislation could change that.Ī rising tide of commentators, scholars and policymakers has noted the growing problem of burdensome occupational licensing laws. Worse still, a perverse policy underlying many state laws almost ensures that many of those in default will never manage to repay their loans. Unfortunately, because of a number of factors, about 5 million Americans are in default on those loans. Americans owe nearly $1.5 trillion in student loans, with the average borrower owing around $30,000.

0 kommentar(er)

0 kommentar(er)